Chime is the Bank of the Future, Because You Can Do it All from Your Couch

You know that little voice in your head telling you how cool something is? Well, it’s Chime Bank. Use Chime and you’ll never leave the couch to manage your money again. Chime Bank is a digital-first bank account here to make your life better. All of the money management of any brick-and-mortar bank, no changing out of pajamas to do it. Because really, it’s 2021. And you should never have to put on pants to head out the door to go check on your money. No bank is perfect, and Chime does have a few drawbacks. But if you’re looking for a better bank, you’ll want to upgrade to Chime. Chime wants you to love banking. That’s a bold goal, and it says a lot about what it’s like to be a Chime member. Chime Bank wants you to fall in love and stay in love with them. There’s no free cooler or toaster for signing up. But you will get:

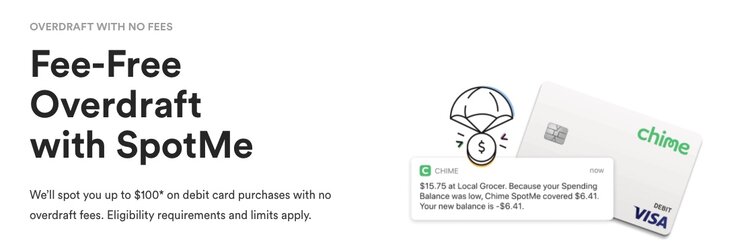

- Real overdraft protection. Not the kind where overdraws go onto a high-interest credit card.

- Balance alerts. Opt in for alerts for every Chime Visa® Debit Card, deposits, or when your balance is getting low.

- Money with friends – for free. Send money, fee free, to friends using the mobile app.

- No more post office runs. Chime signs, steals, and stamps your bills for you.

Those are just a few perks of signing up for Chime, and that’s already a lot to love.

KISS THOSE OVERDRAFT FEES GOOD-BYE: MEET SPOTME

Say Hello to SpotMe and Stop losing $250 a year on overdraft fees. Chime will spot you up to $100 on overdraws up to $100 without charging you any fees.

- There are no ATM fees with Chime Bank. With over 38,000 fee-free ATMs in Chime’s network, you’ll never have to pay $3.95 on that $40 withdrawal again.

- No more maintenance fees. The average bank account holder pays **$10-$12 a month for their checking account. It’s fee-free to bank with Chime.

GET PAID BEFORE PAYDAY!

TOP-NOTCH SECURITY

Your protection is Chime’s priority. Your deposits are insured by the FDIC for up to $250,000. And to protect your personal data, Chime uses military-grade 128-bit AES encryption.

SAVE MONEY WITHOUT HAVING TO THINK ABOUT IT

You might not have the strength or discipline to save money. Let Chime be your willpower. Chime Round Up is the ultimate, easy way to save. Make any purchase and Chime will automatically round up your transaction by a dollar, which gets transferred into a rainy day savings account. And while hundreds of bank and savings apps boast about their features to round up and save, Chime has been singled out by *Forbes for praise as one of the “best round-up apps for saving money”. You can also set up an automatic savings transfer on every direct deposit, too.

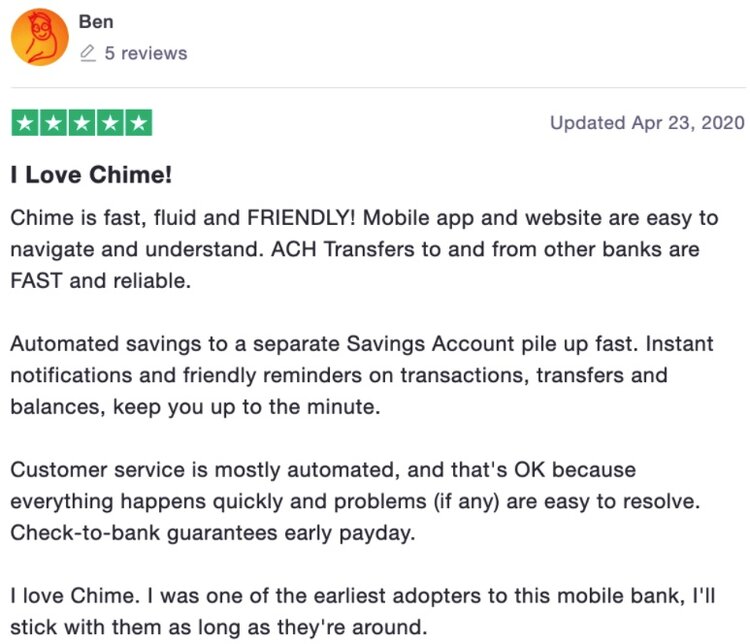

CUSTOMERS LOVE CHIME

Customers are obsessed with Chime, and that says it all. With all the banking debacles in the news, most people don’t even like banks. Yet Chime members, like Ben, are raving about banking with Chime and using the Chime app.

CHIME DOES HAVE A FEW DOWNSIDES

No one’s perfect. Chime has a few downsides.

- Chime doesn’t offer auto loans or mortgages. (But they work closely with Better.com to offer Chime members a great mortgage experience.) They want to focus on giving you an amazing experience for your day-to-day banking.

- Chime doesn’t have any brick-and-mortar locations.

- Chime doesn’t have tellers at local branches to talk to you. Chime has live customer support online, and by phone. (Because your phone does have a calling app.)

SIGN UP IN 2 MINUTES FOR CHIME

It takes two minutes to sign up for Chime. After you’ve signed up your free account, you’ll get a spending or checking account and savings account set up. And it only takes a few more days to get your Chime debit card.*Bankrate.com Checking Account And ATM Fee Study: https://www.bankrate.com/banking/checking/checking-account-survey/ **NerdWallet Average Checking Account Fees Study: https://www.nerdwallet.com/blog/banking/average-checking-account-fees-study/ ***Forbes: https://www.forbes.com/advisor/personal-finance/the-5-best-round-up-apps-for-saving-money/

Promotions & Advertiser Disclosure: This post contains affiliate links and we’ll get a small commission if you choose to sign up through one of our links. Read More

Additionally, information provided in this article about Chime Back, including any remuneration or “bonuses” for the setup of a new Chime Bank account, was current at the date of the article’s publication. Any promotions for Chime Bank, or specific Chime Bank Terms and Conditions are subject to cancelation or modification at any time. Please consult Chime Bank’s website, Chime.com, to review the full Deposit Account Agreement and any other Policies for more information. Swagbucks’ publication of this article should not be construed as direct financial advice. Readers are advised to seek the advice of a qualified financial advisor or planner.

Related Articles

- Best Investment Apps of 2021

- How Much Does It Cost to Own a Car? The True Cost of Car Ownership

- Flipping Land for a Profit

- The Best Way to Invest – Even if You Only Have $100

- Easy Ways to Make Money with Your Dog